If you need any evidence of the strong demand for good property, look no further than Castle Group’s auction and family fun day on September 25, 2022.

The event, attended by more than 2000 people, defied the media doom and gloom, with five homes across three estates sold for record rates. The event (pictured above) was held onsite at Castle Group’s luxury One development located on Fairway Drive in Kellyville.

Key Highlights:

- 2000-plus attendees

- 87 registered bidders

- Two lots sold prior to the auction

- 100 per cent clearance rate

- One lot sold from One Fairway, Kellyville for more than $150,000 above reserve, equating to more than $4500 a metre for land

- 95 Tallawong Road, Rouse Hill—House and land package sold with land at more than $4000 a metre.

“We had twice the people we expected on the day and it’s a testament that good properties in good locations sell in any market. With a 100 per cent clearance rate and record rates achieved, I couldn’t be happier with the result,” Castle Group director Ritchie Perera said.

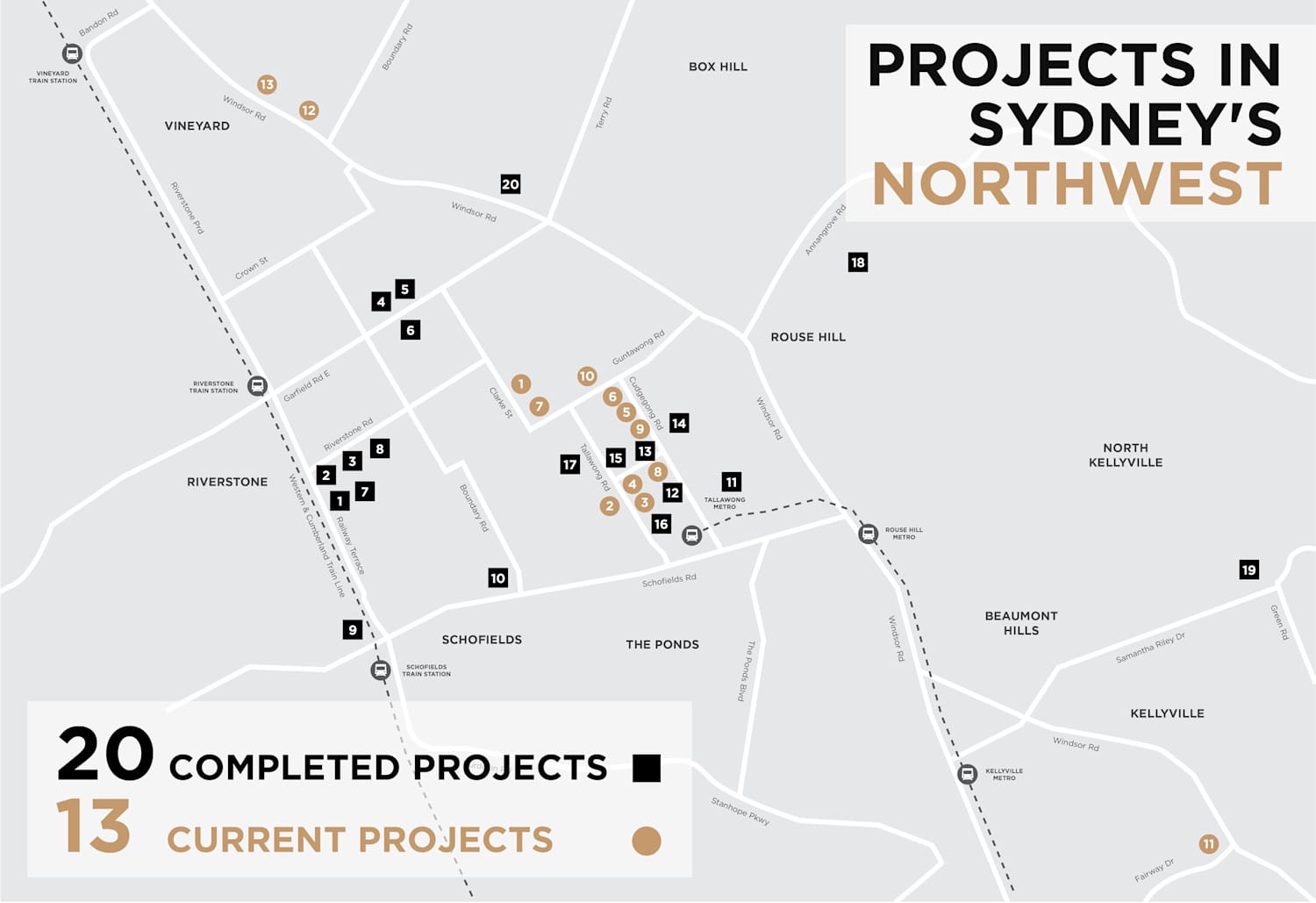

Castle Group have been investing and developing in Sydney’s north-west for more than 10 years and have a $300-million pipeline of projects.

“I’ve been through several market cycles and remain confident in the potential of the north-west Sydney property market. Property moves in cycles but it’s time in the market that leads to success rather than attempting to ‘time’ the market,” Perera said.

“Our auction makes it clear that there is a clear flight to quality. Our ability to identify market trends and cater a product that meets buyer demand has been critical.”

Data from CoreLogic supports the notion that the best way to invest successfully in property is taking a long-term view of the market.

The 2022 Pain and Gain Report found that the median nominal return from resales in The Hills Shire LGA for holding less than two years was $150,000.

These returns get amplified to $775,000—a 517 per cent increase—when holding for a further seven years. Equivalent to $90,000 return a year.

“The foundation of property price growth is supply and demand,” Perera said. Castle Group are heavily invested in Sydney’s growth centres and are the largest landowners in Rouse Hill.

Over the next 10 years, the population of Rouse Hill is expected to grow at 3.6 per cent a year—twice the greater Sydney projections.

It’s that demand that drives Castle Group’s confidence in the market.

“Castle Group has been investing in Rouse Hill for 10 years and has seen it transform from a greenfield suburb on Sydney’s outskirts to easily the most sought-after location in the northwest,” Perera said.

“That’s been driven by the Metro, Rouse Hill Town Centre and Sydney Business Park—only 10 minutes from Rouse Hill.”

Castle Group are marketing estates in Rouse Hill, Vineyard and Kellyville. “We’ve invested significant time and resources to deliver unique housing options that meet the needs of the modern buyer,” Perera said.

Some of the projects Castle Group are now marketing include:

- Park Avenue (Stages 1 and 2)—112 free-standing three, four and five-bedroom park-fronted homes priced below $1.4 million

- One Fairway—40 luxury homes, of which 15 have sold, on the cusp of Bella Vista. The estate is registered and ready to build

- Orchards at Vineyard—18 land lots with custom-designed homes

“With the cash-rate-tightening cycle approaching its end and first-home-buyer incentives hitting the market in January 2023, our projects are well positioned for growth in the years to come,” Perera said.

TOP IMAGE: Record crowds at Castle Group’s Hills Family Fun Day and Auction.

The Urban Developer is proud to partner with Castle Group to deliver this article to you. In doing so, we can continue to publish our daily news, information, insights and opinion to you, our valued readers.