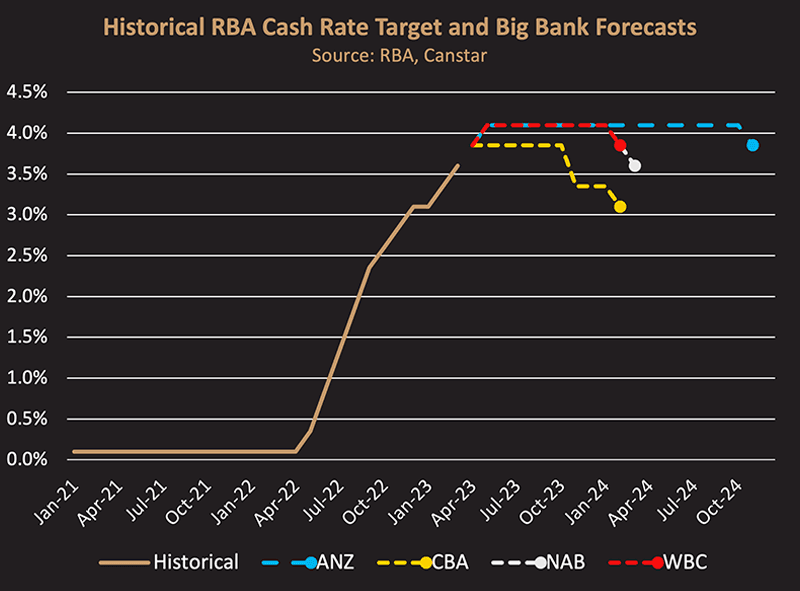

In its April meeting, the Reserve Bank of Australia (RBA) left the cash rate unchanged after 10 consecutive increases. This is in stark contrast to the 0.1 percent cash rate target of 12 months ago. Many banks and economists predict that another pause is on its way when the RBA meet on 2 May 2023.

What do the big banks say?

In March, Canstar shared the cash rate outlook from the big four banks. For borrowers, the more optimistic forecast came from Commonwealth Bank (CBA), which expects a Q3 drop of 50 basis points and more cuts in 2024. The less optimistic forecast comes from ANZ, which expects the cash rate to peak at 4.1 percent, and a first rate cut by November 2024. Either way, it begs the question of what impact these interest rate scenarios could have on the housing market.

There’s a really simple way of thinking about house prices. House prices are a function of the amount a buyer is able to pay, as well as how much they are willing to pay. If competition in a property market is high (as it has been in Sydney for a long time), buyers tend to be willing to pay as much as they can afford.

So, what can buyers afford? Since most homebuyers (other than downsizers and ultra-wealthy cash purchasers) are financing their home through a mortgage, they can afford the deposit they’ve saved (or obtained from relatives), as well as the monthly repayments required. This makes interest rates, household wealth and household income essential components of house prices.

Interest rates, household wealth and household income

According to REA data, it took about four months for the median house price in Rouse Hill to respond to interest rate hikes. However, 3 and 4-bed house prices in the suburb have remained relatively stable over the period. There are a few hints of why this could be the case:

• Household wealth: one positive consequence of the coronavirus pandemic is that it positively impacted household savings. Savings can serve as a deposit for home buyers, and as a cash buffer for homeowners. Saving rates will differ across the country and within socio-economic groups. This will influence each market, including northwest Sydney homes, in different ways.

• Household income: in recent months, Australia’s unemployment rate has been considerably lower than at any other time in the past decade. It is of little surprise that household disposable income has also grown—and at rates higher than other advanced economies such as the UK and US.

• Prevalence of fixed rate loans: there has been much talk of fixed rate loans, and how many borrowers might still be paying lower rates. An ideal scenario for them will be a fixed rate term which outlasts the 2022-23 period of higher interest rates.

What could bring rates down sooner?

Hoping for a lower cash rate is paradoxical. On one hand, lower interest rates ease the pressure on mortgage repayments. On the other, lower interest rates are usually indicative of the RBA’s need to stimulate the economy (implying hardship). However, external events may force the RBA into a lower-rate environment sooner than the big banks expect. One such event is the recent collapse of Silicon Valley Bank (SVB) in the US. Combined with other factors, interest rates were the straw that broke the SVB camel’s back. Assuming demand for housing in northwest Sydney remains buoyant, and household finances remain strong, a series of interest rate cuts on the horizon would inject more energy into this market.